See UPDATE at the end, for a new bonus chart!

Maybe because I am writing this in Japan, but it seems to make sense to use the Japanese term for this post, as in “difficult puzzle” or “impossible contradiction.”1

And the contradiction I refer to derives from a favorite topic of mine to drone on and on about: The Affordability Crisis. I carped about this in two posts this past summer and, like a dog with a bone, I am not going to let it go.

I just don’t see the evidence for an affordability crisis, which I take to mean a situation where the high prices of new cars drive customers from the marketplace, leading us to an ensuing crash in sales and then I guess the end of life on earth (judging from some of the more hysterical writing on this topic).

To refer to just three (non-hysterical) recent headlines:

Even Some High-Income Americans Can’t Afford New Cars Anymore, by Keith Naughton at Bloomberg, November 4.

High prices, rising debt add to ‘affordability crisis,’ by Amanda Harris in Auto Finance News, October 18.

Affordability crisis shrank the market and could do long-term damage, by the editors of Automotive News, September 12.

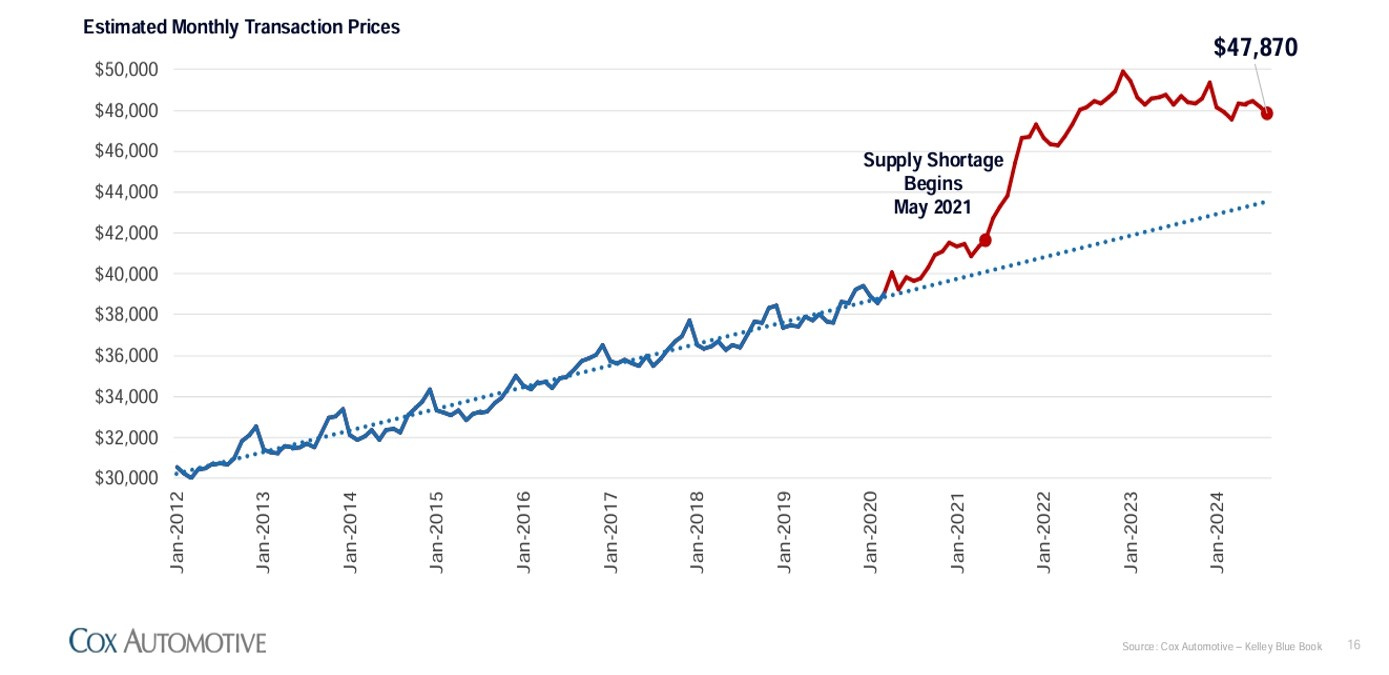

Look, I know I am in the minority here: everyone I talk to seems inflamed by this issue. And yes, I know that dealers and others everywhere would always like better cars with more performance, that also sell for less money. But there are two contradictory charts to answer to here. First, prices for sure are up!2

(As always, thanks to Cox not just for this chart, but for generously providing the industry with massive amounts of data and analysis freely, for many years now.)

Talk about busting a trend line!

Now, last I checked, high or rising prices should be causing demand to fall, yes? But, demand is not down! Turning now to a compendium chart of US unit sales forecasts, from the Alliance for Automotive Innovation (the November 6 edition of Reading the Meter), all four respected forecasters are expecting a unit growth in sales for 2024, over 2023:

(Oh, and with outlooks for more volume growth in 2025.)

I must have not been paying attention in Econ 101, when the professor was drawing supply and demand lines.

Okay, snark aside, yes, I know dealers and OEMs are spending more to get these units moved, and yes, maybe a day of reckoning is coming. Yet I do want to make the argument that maybe, instead, the demand curve in the USA has (permanently?) shifted, because despite all the talk about record prices and high interest rates and elevated monthly payments and etc. etc.: as many Americans are lining up to buy cars now as in several recent years. This fits into my familiar premiumization argument, which is further reinforced by OEMs dropping cheaper models (I will really miss the Fit), and by customers opting for high options loading. These are not hallmarks of an Affordability Crisis.

This reminds me of people complaining about concert ticket prices, and about a certain ticket sales-and-distribution company “gouging” them on fees… but still lining up to pay Taylor Swift $1,000 for a seat.3 And then buying a few hundred bucks worth of swag on the way out.

Affordability Crisis? Maybe, or even certainly, at some point but, to quote that great philosopher, Juba: “…not yet. Not yet!”4

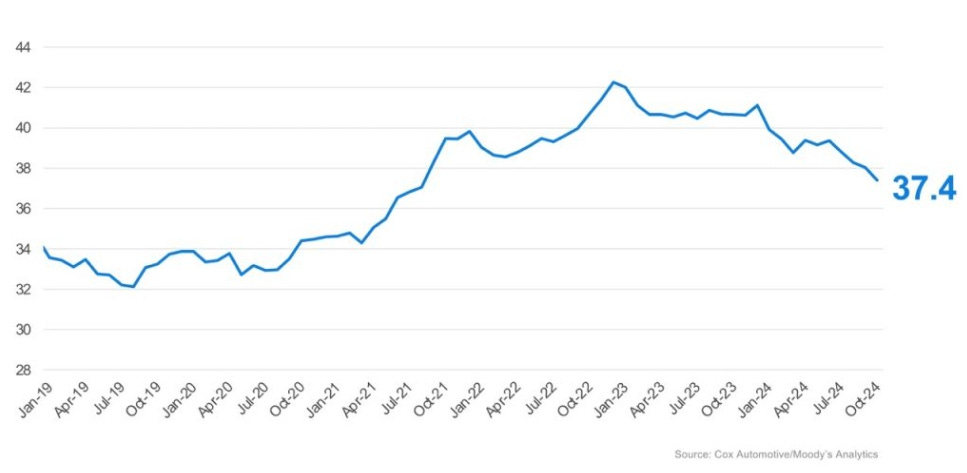

UPDATE CHART, from Cox again (thank you!), presented without comment:

Weeks of Median Family Income Required to Purchase the Average New Vehicle

I’m employing the mostly-incorrect Western usage of kōan as an unsolvable puzzle. But I acknowledge this is not accurate: see Wikipedia as always: “The popular Western understanding sees kōan as referring to an unanswerable question or a meaningless or absurd statement. However, in Zen practice, a kōan is not meaningless, and not a riddle or a puzzle. Teachers do expect students to present an appropriate response when asked about a kōan.”

And note these are prices net of discounts!

I bet most of you will get that reference. Maybe even the very sharp reader who got a previous post’s mystery question right, as to what form of transport has the lowest fatality rate per mile, in terms of pounds of people or goods moved? Pipelines. Correct, sir! It figures, a Princeton guy would get that.