I have been ranting for years about the decline in dealerships’ market share of automotive service (call it parts and labor, repair and maintenance, fixed ops, whatever). Historical data is elusive, but my scouring of past issues of Automotive News indicates that dealers had a 45% share of this market in the 1960s, with a slow but steady decline to about 30% now. The rest, of course, is taken by the independent aftermarket, which has been wonderfully inventive.1

And losing share here is a Big Deal: it’s a $350 billion market at retail, so if dealers clawed back just one percentage point, that would be $3.5 billion, and if that were spread across all 18,000 stores, it’s about $200,000 in very profitable revenue per rooftop2.

But the independent aftermarket offers a key customer benefit that will be hard to match: convenience. There are some 250,000 aftermarket outlets, from regular garages to the service chains and even a few hold-out gas stations that also work on cars. That’s an order of magnitude or so more locations than dealerships offer, making getting the car to an aftermarket shop on average much more convenient than dragging it off to a dealership.

And convenience is king. We can argue endlessly if “customers” (as if they were one monolithic block) like to haggle on new car prices or not, whether they appreciate free coffee in the service area or not, whether low price matters than everything else or not, but I am very sure that there is 100% agreement that no customer ever said “I’d like it to be more difficult for me to get my car serviced.” And so the ubiquity of aftermarket locations is a major competitive advantage.

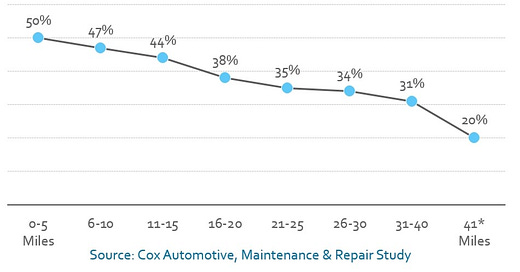

We can see this in real data, notably a great chart from Cox (to whom I am ever grateful for their research work, provided usually gratis to all):

To declare the obvious: if the dealership where I bought my car is far away from where I live, I will be less likely to return to that dealer for service. Dealers of course know this, and try various indirect strategies to overcome the distance barrier, such as by selling service contracts that force the customer to come back, or by offering extended hours that make it easier for the customer to find time to bring the car in. But these strategies do not directly address the distance problem: they do not bring the service department physically closer to the customer. For that we need satellite service (stand-alone service shops located closer to customers) or mobile services (that bring the repair to the customer, much as Safelite does with its mobile windshield replacement vans).

Now, from discussions with dealers over the years I know satellite and mobile service are Not Easy. Can I manage a remote location, on top of running my store? Will my best techs leave my main store for the satellite? Do I have to double-stock ever more parts? Will adjacent dealers object to my entering their territory? Can I afford the cost of insuring all these vans running around? And many other questions.

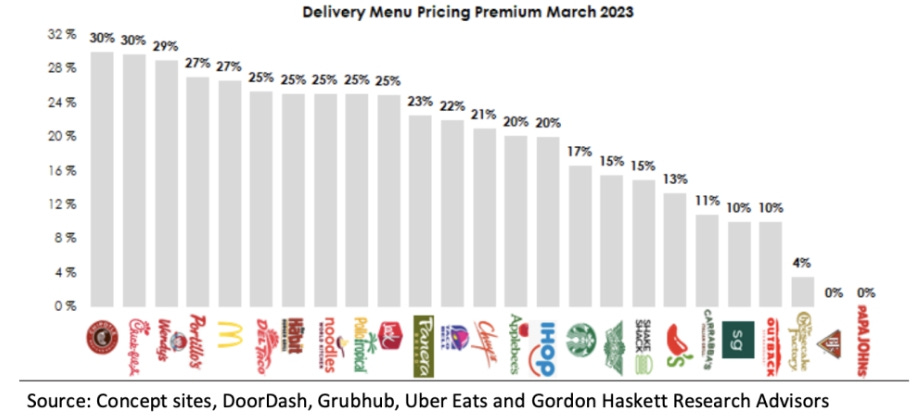

But given my bias that Convenience is King, I want to encourage dealers to give satellite and mobile service another look. And because this is Car Charts, I will back up my urging with a graphic that indicates just how much Americans will pay for convenience, because if they will do so, the ability to charge slightly more at the more convenient satellite should make the decision to try it out easier to take.

The graphic is from the restaurant industry, specifically covering 25 restaurant brands. All of these restaurants allow ordering of food for delivery, typically via third-party services such as DoorDash or Uber Eats. And customers pay for the privilege of convenience, in this case the convenience of home delivery. What is the average premium they pay for this (and for the thrill of receiving soggy fries)? About 20%. To get specific, assume you are very hungry, and order a Big Mac, a Quarter Pounder with Cheese, and a 20-Piece McNuggets at my favorite Scottish food chain. In store the average price for these three is $23. Via delivery, $29. That’s about a 25% premium.

(Thanks to Gordon Haskett for the work, and foodondemand.com for sharing.)

Now, you might say, these upcharges are paid only by a small handful of price-insensitive people desperate for a burger at 2 in the morning. But no, this is in fact a huge industry: at least $30 billion in sales in 2023 (taking an average of estimates by Fundera, Statista, and IMARC). And it is growing3.

True, a 25% premium on burger meal likely does not extrapolate to a 25% premium on a $400 brake job… but it maybe extrapolates to 10%. TBD.

The point is, Americans crave convenience, would like more of it, and seem willing to pay for it, by at least some amount at some time. With all the financial pressures on new-car dealerships, and given the enormous upside (you’ve only got 30% of this market), does it make sense to investigate afresh the potential of remote service? The fast-food industry has been paving the way for you, teaching customers that they need to pay for convenience. Is remote service worth another look?

(By the way, the Kings of Convenience are pretty good, though none of their songs appears to directly reference food delivery.)

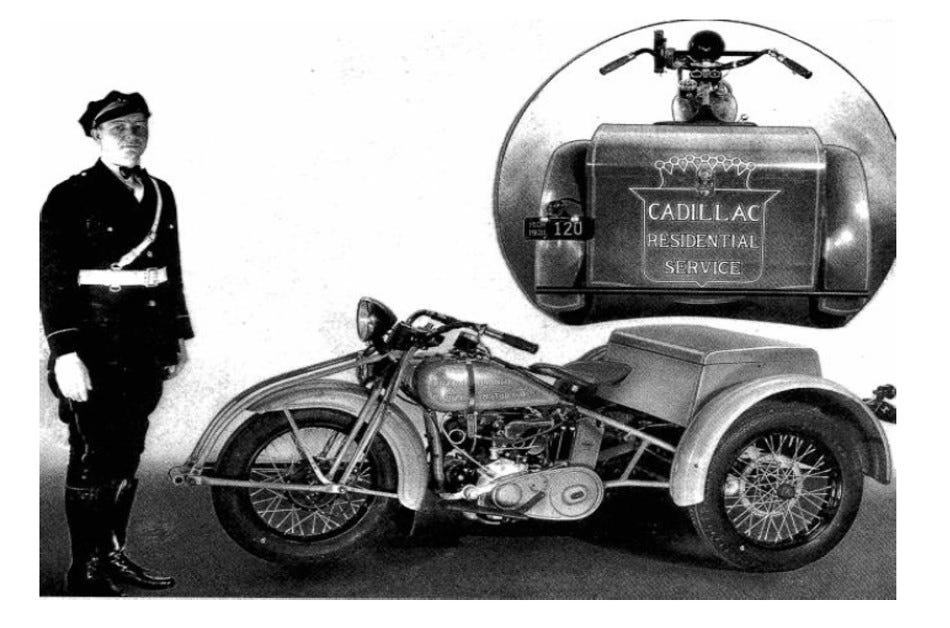

PS: As always, we’ve been here before. Here’s a variation on remote service: the Harley-Davidson Servi-Car, which among other uses could deliver repaired cars to customers. Once your car was fixed, an employee would drive it to your house, towing the Servi-Car behind. Upon delivery of your car, the employee would unhook and ride the Servi-Car back to the dealership. As a trike, it was designed so that anyone could use it, not just motorcycle riders.

I believe the uniform was optional…

Especially in its ability to peel off specific products, and optimize for them. Thus Midas et al. in mufflers (when we still had mild-steel corrosion-prone mufflers), Jiffy Lube et al. in oil changes, Goodyear et al. in tires. Each of these groups of firms could specialize in a few repair types, thus building scale and expertise, whereas dealers were somewhat hobbled by the need to do almost everything that one might require on a car. And note that these aftermarket interlopers could discard the money-losing and time-consuming diagnostic work: the customer would do that work for them. (If I wake up the kids when I start my car, I need a muffler; if the oil change light is on, I need oil; if I have a flat, I need a tire.)

My math skills continue to impress me!

Note that they’ve excluded here home delivery of groceries, which would increase the number, and also excluded pick-up orders, which may save the customer time spent sitting in the upscale ambience of a Rally’s, but still incurs the inconvenience of driving there. (Before the Burger Stans among you jump on me, yes, I know, very very few Rally’s have interior seating. But some have picnic tables, ok?)