Peak Car Revisited (and revised)

Metrics matter

On the one hand, you’ve heard me complaining about this issue before, so sorry - but on the other hand, this issue keeps coming up, thus I’ll address it again, so: not sorry.

The excellent Reilly Brennan (see his great Future of Transportation newsletter here) linked to a recent SAE paper on the challenges facing the US auto industry. And Lord knows these challenges are numerous and severe. But one section of the paper triggered my Peak Car alarm. To quote:

One of the most serious trends affecting the automotive industry is that the sales of new cars have stalled out in North America, Europe, Japan, and South Korea. Fewer new vehicles are sold annually in those markets today than there were a decade ago. This is particularly worrisome in the U.S., where new car sales are lower than they were a decade ago, even though the population of the country increased by more than 30 mm people. It is called Peak Auto, and it is unlikely that new car sales will return to their pre-covid levels anytime soon, if ever.

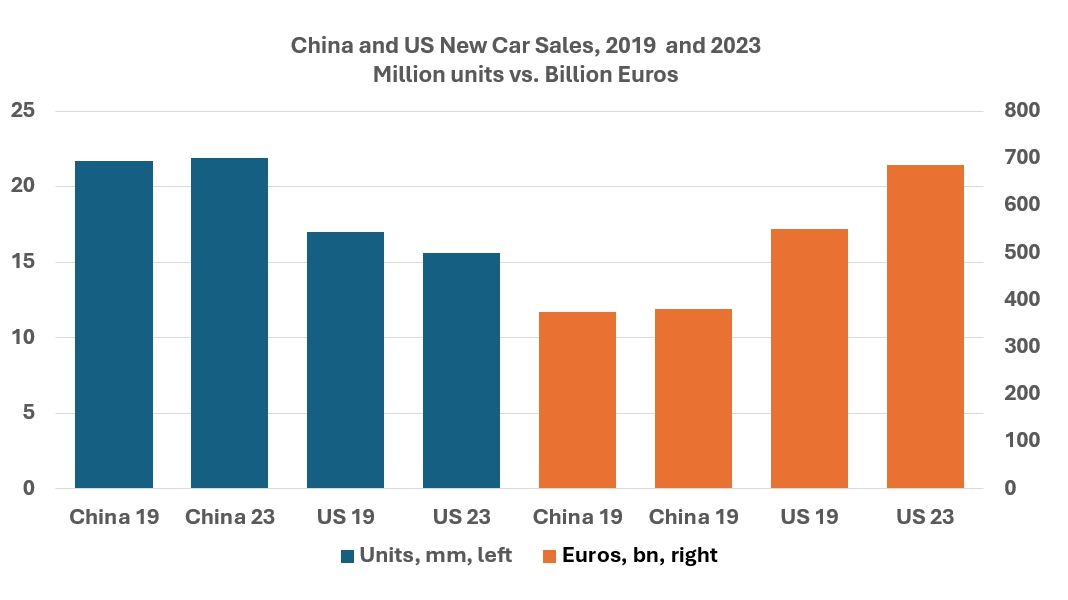

I’ve got no argument with the facts presented here. In these developed markets the annual unit sales of vehicles are indeed likely to be past their peak (especially in countries with falling birth rates). But I do have to push back on how “worrisome” this is. That is because I don’t like the metric, which measures car sales in units, not dollars (or Euros, or yen, etc.). Here’s our chart, courtesy of Alliance Bernstein SG:

I’ve chosen 2019 and 2023 as quasi-normal years (pre- and post- the pandemic and chip shortages). The left four bars use the left Y-axis (millions of units sold), the right four the right Y-axis (billions of Euros of revenue, calculated as average selling price (net of discounts!) times unit volume). What does this chart say about Peak Car? Well, Chinese unit volumes have not grown much (though they are expected to recover), and due to the intense price war raging there, Chinese revenue levels are about flat. Looks like Peak Car, perhaps? But check out the USA: volumes are down (I don’t know when or if we’ll ever get back to 17 million), but revenue is sharply up: from $550 billion in 2019 to $685 billion in 2023. That doesn’t look at all like Peak Car!

Look, unit volumes can’t (and shouldn’t!) grow forever, though I am not about to sit on my Privileged Western porch and tell people in poorer nations they can’t have more cars. So, speaking for the OECD nations only, yes, we are probably at or near Peak Car in unit terms. But only in unit terms in the USA at least (and I bet in China, too, as the price war abates): we have not seen any peak in revenue terms. Price, content, value, all matter.

Yet our industry, perhaps because it is so historically rooted in the production revolution Henry Ford brought about, still keeps score in units, not in dollars or yuan. Thus a Maybach and a Mazda and a Maruti Suzuki all “count” the same, which seems ludicrous to me. I can’t see Starbuck’s reporting annual unit sales of grande lattes, or Walmart announcing it had beaten all rivals in terms of pairs of socks sold, and I think McDonald’s long ago gave up counting the number of burgers they had flipped off the griddle.1

Of course we have to watch both metrics. We’re not going to end up in 2100 selling one $500 billion car. But over any realistic time horizon companies and industries run on revenue, not on units: you can’t pay your suppliers or employees or investors by handing them car parts2 I am concerned about flat or lower volumes, yes, but until revenue drops, I will remain sanguine.

After writing this post I realized I had once again succumbed to Developed Market bias. Peak Car (in units) is something OECD countries are dealing with now, or likely will be dealing with in the near future. But the world is broader than the OECD (this is the type of deep insight you get from Car Charts, eh?). Check this S&P Global sales forecast from October 2024:

We see here, indeed, flat or declining unit sales volumes through 2031 in Japan, Oceania, and West Europe, with North America barely edging up. But the Indian subcontinent, Greater China, MEA, and South America all grow strongly. Peak (unit) car is decidedly not a global phenomenon. Just because wealthier countries may be tiring of the car does not mean that others are also.

Though now that I think of it, that might help with excess supply. Instead of dividends on stocks, mail every shareholder a brake caliper or a headlamp?