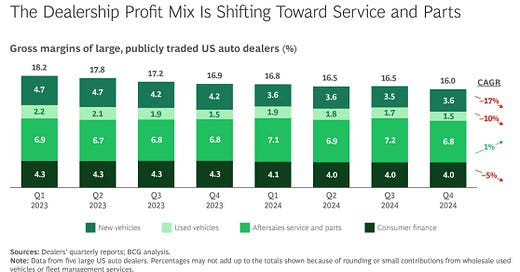

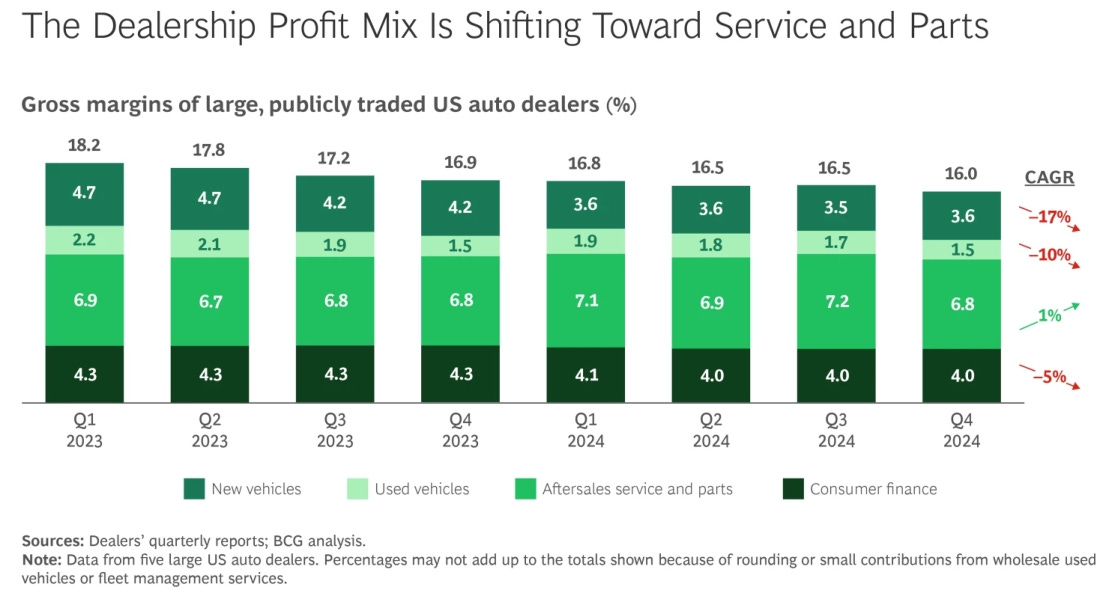

Thanks to Reilly Brennan’s excellent Future of Transportation weekly newsletter, I saw a recent BCG report on the outlook for new-car dealers1 in the USA. Among other things this report included this chart:

No offense to BCG (it’s a good report, please read it!), but this trend will come as a surprise to precisely zero of the ~18,000 new-car dealers in the USA. Over the years the sale of new cars in America has slowly but steadily moved to the classic “give away the razor, sell the blades” model. There are various reasons for this (at the risk of putting you to sleep, one relates to differential price elasticities of demand for service versus sales), but let’s just accept as given that this is where we are: we sell the car not for the margin it earns, but for the profit on the trade-in it brings, the financing it requires, and the service revenue it will eventually generate (both warranty and customer-pay).

But there is another reason for increased dealer focus on service (aka repair and maintenance, aka parts and labor, aka aftersales, aka fixed operations or fixed ops2). This is that the service tail can wag the sales dog: customer satisfaction with how they are treated in the dealer’s service lane can strongly influence whether they buy their next new car from that dealer, or go elsewhere.

This is also not a surprise to franchised dealers, who have known for years that how a customer is treated during service visits makes a huge difference to retention (the likelihood that the customer will eventually come back for a new car). It only makes sense: if I buy a new car every couple of years3 , then the sales experience was one event two years ago, but I’ve been back for five or so service visits since. There is just so much more opportunity for the dealer to make a favorable (or unfavorable) impression with service, than with sales.

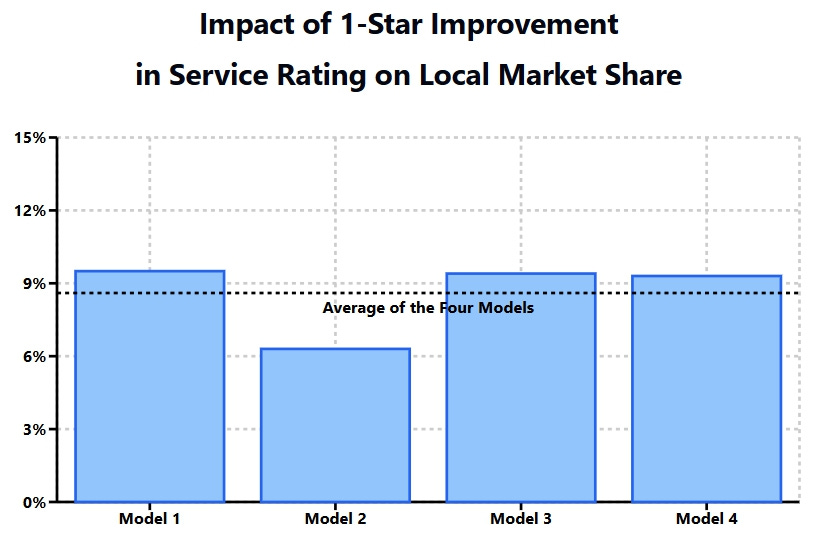

And of course we have a research report4 which quantifies this uplift. Using data from over 1,000 new-car dealerships, the authors were able to connect service satisfaction (as measured by customer reviews on DealerRater) to a dealer’s local sales new-car sales market share. To jump to the punch line:

“We find that the quality of after-sales services positively influences sales of the brand in the dealer’s region. Manufacturers whose dealers struggle with after-sales services take a hit in market share even in markets where they enjoy superior [ vehicle ] competitive status.”

So, how large, you may ask, is this positive influence? Surprise, I made a chart showing the impact on local market share of a one-star (on DealerRater’s five-star system) improvement in service reviews:

That’s a little shy of 9%, averaged across the various estimation models the authors employed. In the primary model, it is 9.5%. To translate that: if a dealer has a 10% local market share (see the paper for the precise definition of this), a one-star improvement in service rating generates a 9.5% (relative) boost, taking share from 10% to about 11%. For those who do not know how hard manufacturers and dealers scrap over even minute gains in share, this is a Very Big Deal.

But we can go further than that, since the authors surveyed as well customer ratings of the car sales process (new-car pricing, trade-in handling, financing arrangements, etc.). And what did they find here?

“We find that after-sales rating has a significant impact on market share, while sales rating does not. A car brand gains a higher market share in markets where it has dealerships with highly rated after-sales service centers. As model 1 … suggests, a one-star increase in average rating is equivalent to a 9.5 percent gain in market share. On the other hand, the quality of sales-related services does not seem to affect market share on average [ emphasis added ].”

Think about that for a minute. Despite all the complaining and moaning about how customers were treated during the new-car sales process,5 that experience (if this study is accurate) just fades away into insignificance, relative to how customers feel about the service experience. Now, of course we have to improve the sales experience! Of course there is no excuse for complacency on that front! But when it comes down to actual numbers measuring actual behavior, whatever dealers (and their OEMs) can do to improve the service experience matters relatively more. The service tail is definitely wagging the sales dog, to repeat my unfortunate metaphor.

If one reads on- or off-line about new-car dealers, the focus is so much on the new-car sales process and the new-car showroom that it would seem as if the rest of the store does not exist: the used-car lot, the service bays, the technicians, the parts warehouse, the administration offices, etc. etc. But the back of the store, despite its lack of glamor and attention, may be where all the action is, in terms of both profits today (from service work it performs) and profits tomorrow (from the new-car sales it generates).

As always, of course, any misinterpretations of these results are my own, and not the fault of the authors, to whom I am grateful for their work.

Time Out for a Mercer Rant: journalists, commentators, analysts, I beg you to get your terms right when you talk about automotive retailing in the USA. The term “dealers” is a broad one that encompasses both independently-owned franchised new-car stores (which, confusingly, also sell used cars) and used-car-only stores (which, confusingly, are often called “independent” dealers).

There are about 18,000 of the former and maybe 30,000 of the latter. (I say “maybe” because no one really knows: if you put two of your brother-in-law’s jalopies up for sale on the driveway in front of your hardware store, are you a dealer? By some measures, you are.) They are only partly in the same business! Franchised stores sell new cars and used cars, get involved in financing both, offer various protection products (e.g. extended service contracts), and maintain and repair cars through combined parts and labor offerings. (And about one third also do collision repair.) Independent dealers sell only used cars (never new), and while they do arrange financing and often protection products, they don’t get very involved in maintenance and repair (one third have no service bays at all, and many of the rest use those bays only to refurbish a car in preparing to sell it).

The blurring of these two categories under the heading “dealers” creates errors similar to the blurring together of constructors of new homes (e.g. Pulte) and remodelers of existing homes (e.g. Jerry’s Carpentry) as “builders.” That term is technically correct, but conceals a world of differences. Thus, to take the present example, the growing importance of service revenue and profits really only applies to franchised dealers, not independents.

And finally, if you want to really confuse yourself, note that Tesla customers often call the store where they bought their car the “dealership.” Without opening up yet another can of worms, I will assert that Tesla stores are not dealerships in the traditional legal or economic sense, and that (for once!) Tesla would agree with me.

There is some debate as to the historical derivation of this term, but basically it highlights the distinction between predictable and steady revenue streams versus variable and less predictable ones. Historically, franchised dealerships divide their operations between variable and fixed. The former includes the sale of new and used vehicles, which are inherently unpredictable (e.g. sales may fall if there is, I dunno, a collapse in the stock market, or rise if, I dunno, customers want to avoid impending tariffs, just sayin’). Fixed Operations refers to the service, parts, and collision repair departments of a franchised dealership, which are considered "fixed" because they involve recurring maintenance and repair needs for vehicles, which can be more reliably forecasted.

Simplistic math: average American household has about 3 cars, holds each about 6 years, and so is back for a new one every two.

Are Dealers Still Relevant? How Dealer Service Quality Impacts Manufacturer Success, by Golara, Dooley, and Mousavi.

As far as my informal estimate goes, bit**ing about the new-car purchase process consumes about 42.3% of all internet traffic, second only to cat videos, at 48.9%.