At present, the discussion of tariffs crowds out every other automotive topic. And the challenges these taxes raise put all our focus on the present day: the past is mostly forgotten and the future is for… later: we’ve got fires to fight right now. But Daniel Roeska and his colleagues over at Bernstein SG have just put out an excellent report that steps back a bit, to provide a historic perspective on the situation, in effect highlighting that, to some extent, the USA’s current pulling up of the drawbridge can be seen as just the latest chapter in a long sad story of the retreat of the Detroit 3 (formerly known as the Big Three).

First a caveat: the following paragraphs will collapse many years and millions of vehicles produced into a very simplistic model of the world that by its very nature is more or less false. But as the saying goes, “All models are wrong - but some are useful.”

Once upon a time… the automotive world was dominated by two constellations of OEMs, from a global perspective. There were plenty of small local players, but internationally there were the Americans and their overseas (remember that term?) arms, dominating the mass market, and the Europeans, dominating the luxury market. That was it. Then out of Japan came a new wave of competitors, outdoing the incumbents with better quality and lower cost. Next came the Koreans, reading from the roughly the same playbook, but with their own distinctive take on it. Now we have China as the new - very large - kid on the block. Thus we have grown from two to five constellations of OEMs, and of course each has chosen its own competitive focus:

The Americans: pickup trucks as the segment, North America as the market

The Europeans: luxury vehicles the segment, the world as the market1

The Japanese: mostly cars and crossovers, often hybrids, sold globally

The Koreans: similar to the Japanese, but increasingly electric

The Chinese: mass-market electric cars, going global

Note that at the peak of each wave of new entrants they seemed impossible to beat2. And indeed each wave did gain ground - and then a new equilibrium was reached. Often reaching the equilibrium involved a great deal of corporate M&A, and alliance-building and breaking3.

But as each wave gained share, someone had to lose share, and unfortunately the Detroit 3 have given up much of that. Hence this dismal chart from Bernstein:

At the start of this century the D3 sold 29% of the world’s cars (measured in units). Now they sell 13% or so. There’s been both passive share loss (as competitors gained) and active (as the D3 pulled back4). This was such a retreat for car companies that once were so eager to go abroad: Ford opened a Model T plant in Manchester in 1911, GM bought Vauxhall in 1925, even Chrysler (a bit late to the game) bought a stake in Simca in 1958.

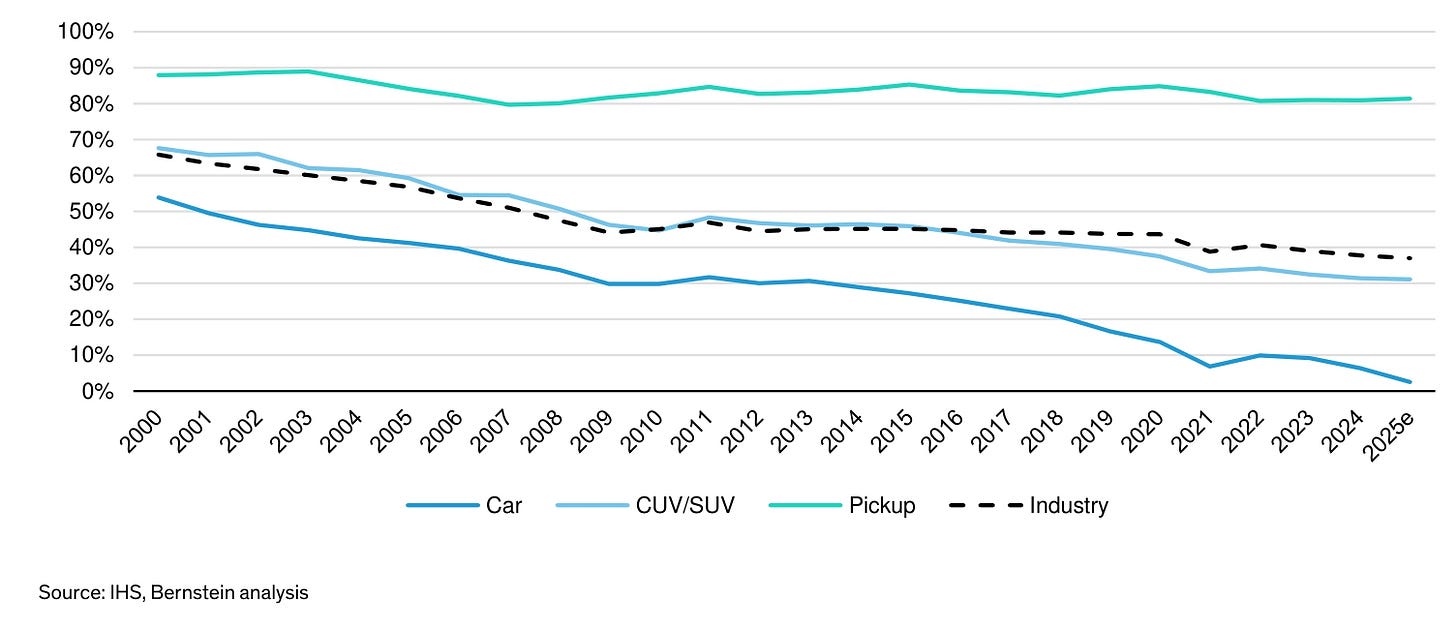

Along with the geographical retreat has been a product line retreat, as our second dismal chart from Bernstein reveals:

Segment Share of the D3 in the US Market

Overall share in the USA has dropped from about 65% to about 38%, and within that the line has been held only in pickups. (One can argue if that is mostly because the Americans are so good at making trucks, or because of the 25% tariff barrier, but I’ll split the difference and say it’s both.) I can only imagine the RPM Henry Ford is spinning right now, if he knows that the company he founded basically just doesn’t make cars any more.

Where are the D3 headed? It is hard to see how they recover abroad, or if they even want to, as the Chinese expand, and as the local champions dig in for a long battle. At home their most lucrative product is safe behind the tariff wall5, and I for one don’t see that changing, as long as China and the USA are at daggers drawn. So maybe the global equilibrium shifts, but not the national one.

So here’s a question: who’s next? Ten years from now who will be the aggressive, up-and-coming, new kid on the block? Maybe no one seems likely at present, but remember that the Korean industry, now fifth largest in the world, hadn’t made even one car as recently as 1960. India is the consensus choice I’d say, but Vietnam is making a run for it, and Indonesia certainly has the scale and resources. Your votes?

(My ancestry makes me say “Scotland!” Bring back the Galloway, which as a car company had the special distinction of being run and staffed largely by women.)

And a former focus on diesel as the way to approach the emissions challenge. Oops.

Remember back in 1988’s Die Hard, Bruce Willis was fighting his way out of a Japanese company’s building in downtown LA, and in 1993’s Rising Sun Sean Connery and Wesley Snipes were (also in LA) trying to resolve a murder related to a hostile takeover by a Japanese firm of…. an American semiconductor company, of all things. Some anxieties recur, even if their focus shifts.

With poor battered Chrysler either the acquiror or acquiree in an amazing number of transactions over the years. It is indeed sad to see that this firm, now exactly one century old, goes to market in the USA with only two models, both minivans.

Ford sold off Jaguar Land Rover and Volvo, GM ditched Opel. The Ford/Mazda alliance dissolved, GM’s links to Suzuki and Isuzu dissolved (but it did buy much of Daewoo), Chrysler let go of Mitsubishi, etc.

I will leave it to sharper wits than mine to point out at least two spectacular Game of Thrones ironies, if one applies that show’s Wall to our situation, as a metaphor. First, the Wall that defends Westeros is made entirely out of ice (ahem, ICE); and second, it defends the southern realms against the north, which is, I guess, Canada? Here in Cleveland we stand as the first line of defense against any Canadian attacks. We will recognize their troops because they will be clutching Tim Horton’s cups, and be armed with CCM and Bauer hockey sticks!