Happy New Year to my thousands hundreds dozens of readers! Sorry for the pause in posting and I’d like to say it was because I was in LA negotiating the film rights to Car Charts1, but no, it was just The Holidays (which somehow seem more like work than work does) and a family wedding. Anyway, back to it…

As someone who periodically spouts off about the future of the industry, it’s only fair that I claim responsibility for my horrible misses as well as my fortuitous hits. And here’s a big one: since about 2010 I haven’t thought F&I income PNVR (per new vehicle retailed) could go any higher. Which means I’ve been wrong about this for more than a decade. I am officially throwing in the towel, and declaring as my new forecast that F&I PNVR (in the USA) will be $500,000 in 2030.

There, got that out of the way.

By the way, this post will be more than usually focused on the USA, partly because the F&I regulatory environment and the resulting feasible scope of business tends to vary a great deal among nations (driven in some part by differing tax treatments of car finance), and partly because I find this topic woefully under-studied and under-managed outside the USA. Frankly, in my world travels, I find dealers and OEMs outside the United States mostly stunned at the scale and scope of our F&I penetration and revenues. So, you’ve been warned: American focus here.

For the uninitiated, F&I means Finance and Insurance, intangible products which a dealer or a car company (or more accurately its captive finance company) or financial institution try to sell to persons buying a car. Traditionally the only product sold was the F portion of F&I, the financing of the car: the loan or lease, for the placing of which the dealer would receive a payment from the OEM or captive or bank. Typically the payment would flow through a reserve account and typically the “commission” for a loan would be significantly larger than for a lease. (There are many complications here which I am going to just walk on by, for simplicity’s sake.)

In more recent years the I portion of F&I has been its real growth engine, such that today an American consumer might be offered all of these Voluntary Protection Products (as I is more formally and accurately known): pre-paid maintenance plans, extended service warranties, GAP insurance (that pays off any loan balance in excess of insurance redemption should the car be stolen or totaled), tire & wheel repair plans, key replacement (especially costly with modern electronic fobs), anti-theft technology, interior and exterior maintenance products (e.g. paintless dent repair), etc. etc.2

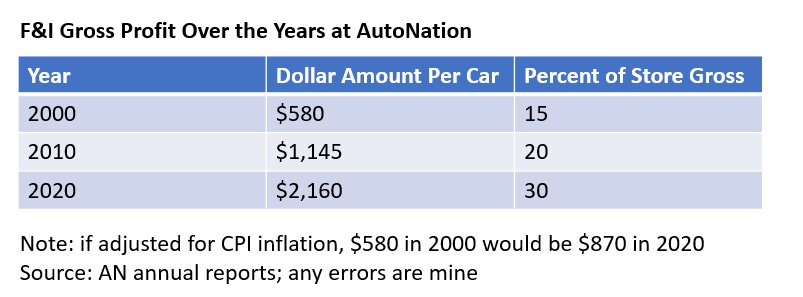

Along with the proliferation of I products to sell has come the professionalization and systemization of the processes by which they are sold. No longer dismissed as an afterthought to the vehicle sale, F&I departments are now prioritized by dealers, staffed professionally by well-trained and -compensated employees, guided by rigorous “menu selling” sales tools, and supported by literally hundreds of vendors of F&I products. (And we must give a lot of credit for this development to the public dealership chains, where many of the first initiatives around F&I growth were launched.) Which leads us to today’s killer chart, which shows us just how important F&I has become:

I use AutoNation data here because it is public and so releases this data, and in my view it is representative of overall industry trends.

It’s a simple chart but the message is very clear. Even as new-car margins may have ebbed, F&I margins have risen to take up the slack. The F&I department is absolutely crucial to dealership profitability today. And it punches above its weight as it were, as its profit margins are higher than in many other parts of the store. To illustrate, let’s take a look a public chain Asbury’s Q3 2022 results, which disclose that F&I is just 5% of company revenue but about 25% of company gross profit.3

(All of this is well known to American dealers, but as I mentioned this story may elude dealers and OEMs active in the rest of the world. Of course dealers everywhere pursue F&I income, but my review of public accounts of several large non-USA dealers reveals almost no discussion of the topic at all. Whether because this is a untapped market elsewhere or whether the US market is somehow uniquely set up to capture F&I revenue, I do not know.)

Where might American F&I go now (on its way to $500,000 per car)? Well, one supposes penetration rates can go even higher, but industry research Colonnade Advisors pegs current F&I product penetration at about 95%. (Of course, that does not mean that every car in that 95% carries every product!) And there are new I products still being invented: we have warranty and service plans tailored to EVs (and their batteries) starting to emerge, and even products responding to customer unease about the increasing amounts of inscrutable (and costly to fix) technology in their cars. For example, AUL Corp. has developed an insurance product providing “advanced coverage for advanced technology,” such as car ADAS, Bluetooth, navigation, and camera systems.4

Furthermore, it looks like OEMs and their channel partners may finally be getting into the biggest I product of all: standard auto insurance — collision, liability, comprehensive, etc. For a variety of reasons I won’t go into here, USA OEMs and dealers have to date not participated in this market in any significant way, despite its enormous size (over $300 billion in annual premiums, though of course this covers the entire 285 million vehicles on our roads, not just annual new sales in the 15-17 million range). But GM and Tesla and others have made and are making moves here now.5

But I think there is another tailwind behind F&I growth, which relates to my thesis (see my July 2022 post) that the entire new-car market in the USA is becoming a “premium” market. As the average income of the average new car buyer grows, and as the average price of the new car bought also rises, then a) we have a buyer more able to afford F&I products and b) a car so expensive that splashing out for some insurance options makes more sense: you’d opt for good insurance coverage on your mansion, but you might skip it on your cheap garden shed.6

So the outlook seems rosy. But there are at least two clouds on the horizon. First, regulators are IMHO genetically predisposed to be wary of big-ticket intangibles, whether these are insurance policies or cryptocurrencies. There is real fear that, as opposed to physical products, intangible products’ true costs and benefits can be misrepresented and the customer led astray. And indeed we are seeing FTC (Federal Trade Commission) activity in the USA in this area now. Careful design of products and processes can avert trouble on this front, and so I always refer readers to NADA’s Voluntary Protection Products guidelines for assistance here.

The second concern regards disintermediation of F&I revenue flows due to Connected Car technology. Certainly virtually every new car sold in the USA will possess CC capabilities in the near future. The advantages of CC are numerous, including of course the ability to remotely and quickly download vehicle software improvements, via Over-The-Air (OTA) updates, making, for example, some safety-related recalls cheaper, faster, and more comprehensive. But to the extent the connected car can enable direct communications between OEMs and customers, especially in the sale of intangibles, thus bypassing the dealer (or agent, or You-Name-The-Channel), the opportunity for disintermediation arises. If you believe F&I products are sold, the dealer probably is less at risk in a CC environment, but if you believe they are bought (I think the distinction should be clear), then we may have a Problem. Especially if regular car insurance (that $300 billion behemoth I mentioned) comes into play, we may have a Big Problem.

Meanwhile, however, the F&I industry seems likely to continue to thrive, and - who knows? - might even hit that $500,000 PNVR target. Or maybe not. But in any case, in my view F&I remains the most significant profit driver inside the American automotive retail, that almost no one outside the industry itself talks about.

I’m thinking Clooney to play me, but my friends suggest DeVito.

Note that some of these are not purely intangible products: for example, an anti-theft product might involve etching the VIN on a vehicle’s glazing. But even these products will tend to be sold by the dealership’s F&I department, which first started appearing in American dealers in the 1960s.

And Asbury also tells us, reinforcing my earlier point about the rise of I (versus F), that for them I is about 70% of total F&I gross profit, with F at 30%.

See: https://aulcorp.com/media/1347/aul-tech-2pager-03122020.pdf

And this area is one where the rest of the world leads the USA, rather than trails it: in numerous other countries regular car insurance indeed passes through the hands of the car sales channel.

Now, if you had two sheds… Sorry, Python fans, I could not resist!